The Decentralized Autonomous Organization (DAO): Definition, Purpose, and Example

Decentralized Autonomous Organizations (DAOs) are rapidly emerging as a new form of organization and governance. A DAO is an autonomous, decentralized entity that is governed by its members through voting and consensus-based decision-making. This type of organizational structure eliminates the need for a central government authority or hierarchy to make decisions, instead relying on its members to come to an agreement in order to move forward with projects or initiatives.

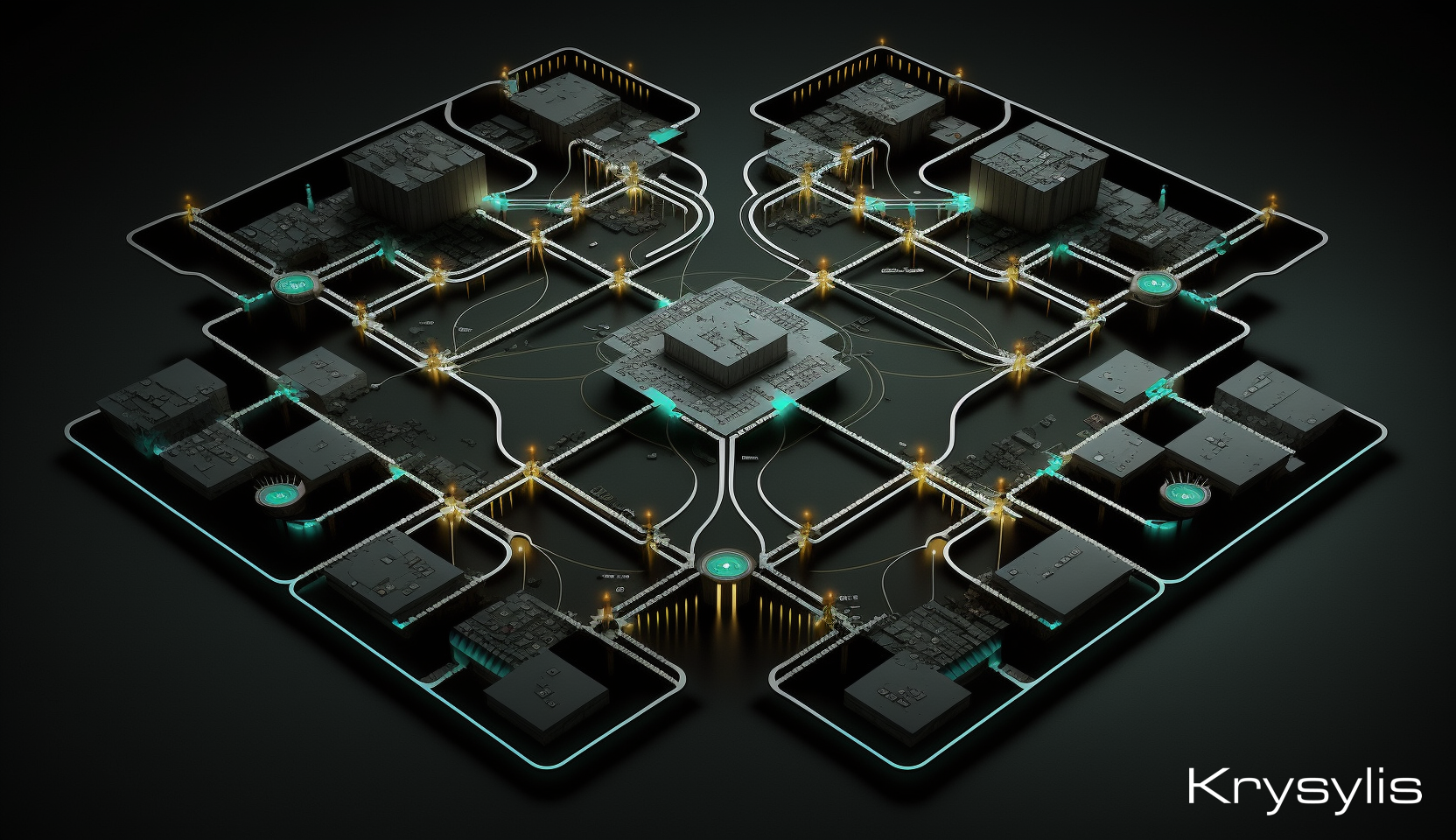

By utilizing blockchain technology and smart contract architecture, DAOs can securely store data while also ensuring transparency among all involved parties. In this article, we will explore what exactly a DAO is, why it’s important, and provide an example of one in action.

What Are Decentralized Autonomous Organizations (DAOs)?

The DAO. Defined.

A DAO is a type of organization that operates on a decentralized platform, such as a blockchain. It is autonomous in the sense that it is self-governed and self-executing, meaning that it does not require a central authority to manage its affairs. Rather, all decisions are made through a consensus-based approach in which every member has a voice.

DAOs are designed to solve the problems of traditional centralized organizations, where power is concentrated in the hands of a few decision-makers, which can lead to corruption and inequality. The absence of a central authority in a DAO makes decision-making fair, transparent, and efficient.

How Do DAOs Work?

Once the organization is established, one can join the DAO by purchasing the organization's native token or cryptocurrency ("governance tokens"), which gives them voting power and other privileges within the organization. Token holders are then considered "members" of the DAO.

The Importance of DAO Governance Tokens

A governance token is a type of cryptocurrency that grants holders the right to vote on certain decisions within the organization. These crypto tokens typically represent a share of ownership and influence in the DAO, allowing members to have a say in important decisions such as funding proposals, budget approvals/changes, moving to fund legal defense, changes to the code, and the overall direction of the organization.

Token holders can freely submit proposals or vote on existing ones, with the weight of their vote determined by the number of tokens they hold. This mechanism ensures that decision-making power is distributed fairly among members and prevents centralization of power.

However, the effectiveness of these tokens depends on the degree to which they are distributed equitably and the rules governing their use are transparent and clearly defined. Nonetheless, governance tokens are an essential component of the DAO, providing a means for members to have a say in the organization's affairs and fostering a sense of community and ownership.

The system processes and verifies votes, and if a majority agrees, the proposal is approved and executed by the contract.

The Voting Process...

In DAOs, the voting process is usually determined by the number of native tokens each member holds. This means that the more tokens you have, the more voting power you have within the organization. However, some DAOs may implement other voting mechanisms to ensure fairness, such as quadratic voting, in which voting power is determined by the square root of the number of tokens or cryptocurrency held.

All decisions, transactions, and interactions are recorded on the blockchain, which ensures that everything is publicly visible and allows for easier auditing and accountability.

Governance Supported on Smart Contracts

The governing structure of a DAO is based on smart contracts, which are self-executing programs that automatically facilitate, verify, and enforce the rules of the organization. Members of a DAO are given voting rights to decide on important matters of the organization such as budget allocations, investment strategies, and project priorities.

DAOs are already being used in various industries such as finance, supply chain management, and gaming. For instance, in the gaming industry, DAOs are being used to manage virtual assets, while in the finance industry, DAOs are being used to manage investment funds. They have become particularly popular in the world of decentralized finance (DeFi), as they enable investors to pool their resources and invest in a broad range of DeFi projects.

An example of a DAO will be explained in more detail later in this article.

How does a DAO make money?

DAOs can generate revenue through a variety of mechanisms, depending on the organization's purpose. One common method is by generating profits from investments and other financial activities. For example, a DAO that specializes in DeFi investments can pool members' funds to invest in promising projects, then earns a return on those investments.

Another way DAOs can make money is by providing services that generate revenue, such as software development or consulting services. In this case, members contribute their skills and expertise to the organization, which then offers its services to clients in exchange for payment.

DAOs can also create their own products or services, such as software applications or gaming platforms. In these cases, the organization can generate revenue through sales or by taking a percentage of user transactions.

Furthermore, DAOs have the ability to raise money through initial coin offerings (ICOs) or token sales, in which members and other investors purchase the organization's cryptocurrency or tokens. This can provide a significant amount of funding upfront, which the DAO can then use to invest, provide services, or develop products.

Finally, some DAOs may rely on donations or grants from supporters and sponsors. In these cases, the organization operates as a non-profit, with the goal of providing a valuable service or advancing a particular cause.

The Benefits of a DAO - A Consideration For Organizations?

DAOs offer many benefits compared to traditional, centralized organizations. Traditional companies are typically structured in a way where decisions are made by a centralized authority, such as a board of directors or a CEO. See the main benefits, below.

The introduction of DAOs marks a significant impact on the way organizations can operate. Without a centralized authority or centralized leadership, the democratic decision-making process of the DAO ecosystem is a marked difference from traditional organizations. It is because of this difference that DAOs have the potential to revolutionize the way organizations operate. The main benefits are:

1) Transparency & Accountability

First and foremost, DAOs provide a level of transparency and accountability that is difficult to achieve with traditional organizations. As all decisions are recorded on the blockchain, it is impossible to hide or manipulate information, which ensures that everything is publicly visible and auditable. This transparency engenders trust among members and promotes a culture of honesty and integrity, which is critical for the success of any organization.

2) No More Intermediaries

Furthermore, DAOs eliminate the need for intermediaries and reduce transaction costs. In traditional organizations, intermediaries such as lawyers, banks, and accountants are often required to establish trust and ensure compliance with regulations. These intermediaries add significant costs and complexity to the organization. DAOs can streamline processes, reduce costs, and increase efficiency.

3) Serve the Best Interests of the Organization

Another key advantage of DAOs is their decentralization and the resulting democratic decision-making process. In traditional organizations, decisions are often made by a centralized authority, such as a board of directors or a CEO. This can lead to situations where the interests of the authority do not align with the interests of the organization or its members. In a DAO, decisions are made by consensus among members, which ensures that everyone has a voice and that decisions are in the best interests of the organization as a whole.

4) Flexibility & Adaptability That Organizations Desire

Finally, DAOs offer greater flexibility and adaptability compared to traditional organizations. DAOs adapt to changing circumstances and new opportunities. For example, if the organization wants to change its investment strategy or pivot to a new service, it can do so quickly and efficiently. This agility is critical in fast-moving industries and markets, where speed and flexibility are necessary for success.

Limitations of DAOs

While they provide many benefits over traditional, centralized organizations, DAOs also have certain drawbacks.

From the difficulty in achieving consensus among members to the potential for malicious actors to use voting to manipulate outcomes, there are several potential flaws that can undermine the effectiveness and efficiency of a DAO. Without proper governance structures in place, it may be difficult for a DAO to adjust quickly in an ever-changing environment. Despite these challenges, DAOs can still offer significant advantages over traditional methods of organizing and interacting with each other.

Current Legal Status of DAOs

The legal status of Decentralized Autonomous Organizations (DAOs) is still in flux, as the concept has only recently emerged. Many countries are currently examining how to regulate and classify these organizations.

As DAOs rely heavily on blockchain and crypto technologies, their unique structure complicates traditional regulatory frameworks. So far, some jurisdictions have classified them as non-profits while others have chosen to treat them like other companies or corporations. In any case, it is important for governments to provide clear guidance on how DAOs should be handled from both a legal and taxation standpoint. Consider consulting with a local legal expert for specific regulatory guidance related to DAO formation, legal structure, and compliance.

DAO Example

An Investment or Venture Capital Fund

A theoretical example of a DAO could be a decentralized investment fund. Instead of a centralized authority making investment decisions, the members of the fund would have a democratic say in which projects to invest in.

Using blockchain technology, every transaction and decision would be publicly visible and auditable, ensuring transparency and accountability. Smart contracts would be used to automatically execute investment decisions, eliminating the need for intermediaries such as banks or brokers, thereby reducing costs.

Through the democratic decision-making process, the fund would have the flexibility to pivot and adapt its investment strategy quickly in response to changing market conditions or emerging opportunities. Community members could propose projects for investment, and if approved by a majority vote, the investment would automatically be made via the smart contract.

The fund could be open to a wide range of investors, including small retail investors, who would typically be excluded from investing in traditional funds due to high minimum investment requirements and high fees.

However, governance would be crucial to ensuring the success and integrity of the fund. The fund would need a well-designed governance structure to prevent malicious actors from manipulating voting outcomes or making bad investment decisions. Additionally, the contracts would need to be audited regularly to ensure they are functioning correctly and not vulnerable to bugs or hacks.

Despite the challenges, a decentralized investment fund would offer many advantages over traditional funds, including lower costs, greater transparency, and democratic decision-making. As the technology and adoption of DAOs continue to mature, we can expect to see even greater innovation and transformation in the way we invest and interact with each other in the financial world.

Starting Your First DAO & Looking for Help?

Whether you currently operate a Decentralized Autonomous Organization (DAO) or are looking to start one, the advisory services provided by Krysylis will help guide you in the right direction to promote overall organizational success. For best-in-class advice related to DAO formation strategy, organization structure, operations/general business management or marketing, contact Krysylis today.

Disclaimer: Krysylis does not provide any financial or legal advice. Krysylis is a business that provides advisory consulting services for professionals and teams that are tailored toward operations, strategy, and executive leadership.